Yes, it has happened. The consistent tales that you have read regarding ‘China climbing’ over the past 15 years have happened. India China tensions have increased. On an acquiring power parity (PPP) basis, China’s GDP has already exceeded that of the USA and is more than five times India’s GDP.

China has recently continued to maintain its status as the globe’s largest exporter and supplier. It is just a matter of time when its military costs begin matching the United States’ armed forces budget.

However, China shall be unlike any superpower we have seen.

What is Different About this India China conflict?

President Xi Jinping, while further cementing his control over the Chinese Communist Party throughout its National Congress in Beijing last month, made patently clear what close China-watchers have known for many years.

The Communist Party of China has no objective of allowing China to reach the ‘end of background’– that is becoming free-trade caring freedom like the USA. Power is to be monopolized by the Communist Party of China as well as “erroneous perspectives,” as Xi Jinping placed it in his stultifying three and a half hr speech and strictly kept an eye on.

With the proof of a four-decade-long run of continuous as well as radical enhancement in living criteria behind him, Xi likewise placed the Chinese ‘design’ as a choice to the Western ‘model’ for other countries to adhere to on their path to modernization.

Watch the video to know more about India China economic relations and dependencies.

India discovers itself at an unclear point in the wake of the rising tyrannical and mercantilist superpower. Its defiance against baseless Chinese incursion into its allies’ territory– as apparent in Doklam recently– is matched just by its economic dependence on China. It is time we wonder about whether the highly asymmetrical Indo-Chinese financial partnership remains in India’s interest.

Economical Relation Asymmetry

India’s trade with China mirrors a colonial-metropole profession partnership that would delight a Marxist teacher. The nest exports resources, while importing finished goods from the metropole. At the same time, the swarm typically runs a persistent trade deficit with the metropole and is prone to the harmful fluctuations of the global resources’ costs.

To China, we export iron ores, granite, aluminum, fine-tuned copper, raw cotton, among other commodities– totaling to about $10 billion. And yet, we import roughly six times the quantity. This consists of practically all good manners of phones and electronics, solar panels, specialized steel among various other manufactured items. A lot of these goods made utilizing our raw materials exported to China.

Out of the complete profession of about $70 billion, India runs a deficiency of $50 billion. India’s smartphone, renewable energy, and also construction development tale is paying the Chinese working people for its success. This will play a big role in the India China future relations.

This Has Been Going On Since The British Era

In recent history, the just other time the subcontinent has had such a coldly unequal trade setup was with Britain throughout the Raj. In return for Indian cotton and also ore, England exported to India textiles, machinery, and even steel.

Historians unanimously concur that such distortion in trade essentially stunted the Indian industrial base while helping Britain industrialize. First commercial spin-offs took root in India only during the First World War- imposed protectionism.

This unequal financial relationship was one of the most awesome debates versus colonialism of the Raj, voiced by anti-colonialists throughout the spectrum, from the Indian National Congress before Independence to the RSS in the 21st century. Why should the Indo-Chinese professional relationship not undergo the very same review?

Excessive Startup Funding Influx

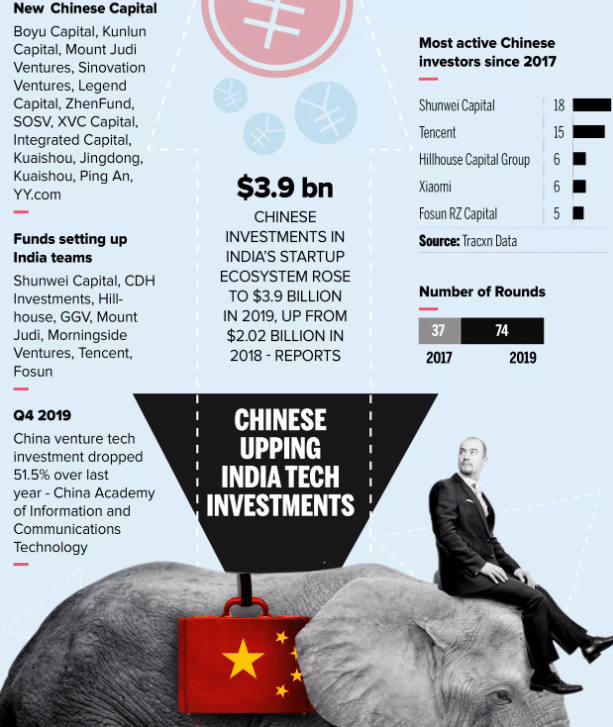

In addition to this stunningly out of balance Indo-Chinese profession, India’s startups to an unpleasant degree are being funded by Chinese funds and tech behemoths.

The leading doyens of the Indian tech market– Paytm, Flipkart, Snapdeal, Ola, MakeMyTrip, and also Hike. In their look for cash for fighting Silicon Valley titans in their home turfs, these companies are currently progressively admiring the Chinese investment class.

Alibaba is the bulk investor in PayTM. Snapdeal and Flipkart, considering that 2016 and 2017 have significantly bankrolled by Alibaba-related funds and Chinese net giant, Tencent.

The reflating of the Indian tech-bubble in 2017— with more than $9 billion of funding this year compared to 2016’s $4.6 billion– appears to drive on the back of Chinese investors. It has led to China ending up being the premium path for new Indian startups searching for funding.

Why Indian Startups Like China?

Without a doubt, the Chinese technology industry’s experience of accommodating a billion low-income customers as well as its importance for the Indian context is a significant reason why a great deal of Indian launch appreciates Chinese funds, technology giants as well as financiers.

Additionally, the Chinese titans appear to be as dominant on their home turf as the Silicon Valley giants in the United States– giving them adequate money and a pillow to spend overseas.

Entrepreneurs need proper business coaching and mindset coaching and need to know how to keep their motivation levels high.

However, to any shrewd viewer of Chinese politics– this enhancing mixture of Chinese capital in India’s technology field needs to be a cause for worry. This may ruffle some feathers in the India China conflict in 2020.

CCP’s Hidden Agendas and Tactics

The crucial factor is the fundamental conflict between the Chinese and also the Indian systems of governance. India China conflict will see governments play a huge role.

When it comes to the Chinese, the financial investment class not only has a clear nationality and loyalty but is directly accountable to an organ that recognizes no regulation over its writ– the Chinese Communist Party (CCP).

An essential approach of CCP’s totalitarian control over Chinese politics has been to avoid the surge of an alternate power center fanatically. This extends to the avoidance of the rise of other independent political celebrations. The Chinese constitution warranties monopoly of political power to the CCP.

The CCP put merely, can not accept a significant organization– any substantial organization– outside its control.

This example describes the Chinese state’s cruel oppression of the Falun Gong sect, a religious organization entailing millions of enthusiasts whose meditation techniques are motivated by Buddhism and Taoism.

As well as the regular crackdowns, the Chinese state frequently releases on Islam and Christianity within its boundaries. Most significantly, however, this control considerably broadens to China’s very own capitalist course. India China situation will be based on the handling of CCP’s agendas.

Reconciling Political Totalitarianism

To reconcile political totalitarianism with state-managed economic liberty, the Chinese state has effectively mandated the vineyard of event cells in the majority of China’s large companies– public and exclusive. In effect, the majority of large corporations have a battery– in the form of a department or a board– that typically works as a branch of the CCP.

This effectively acts as a planted decoy to be switched on in case the corporation flouts borders set by the party or when the celebration needs a favor. Along with such institutional control, the CCP will certainly additionally not tolerate any open deviation from the party line by any one of China’s progressively numerous billionaires.

For that reason, in case a high executive, a billionaire, or his corporation, that might be offering to India or buying it, does not tow the national party line, the CCP inevitably causes among its control systems. India China involves a several HNWIs and they’ll play an important role.

This might range from activating its party cells within the firm to smothering financing to the company through the mainly state-owned economic system to, in one of the most extreme cases, primarily taking in the billionaires as well as the various other vital choice manufacturers right into the extra-legal system and overturning them via torture and also jail time.

Chinese Billionaires Can’t Do What American Billionaires Can

It is practically uncommon in China, for a CEO or a billionaire to do what Tim Cook, Sundar Pichai, and George Soros do routinely in the United States today– honestly flout the existing government policy. Neither do these corporations or billionaires have a final court of appeal– there exists no independent judiciary in China.

How Can India Fight Back?

In sum, India’s economic relationship with China is characterized by an exceptionally high reliance on Chinese imports and also funding from a Chinese industrial and investor course that can never tell any political emperors when asked for a favor. India China have an interesting relationship.

What must India do? Learn from what the Chinese do as well as not what they state. When Xi Jinping spurted concerning free trade at Davos in January of 2017, he was proceeding the game his precursors had been playing for long– sing the tune of open market as well as free markets in public as well as do reasonably the contrary.

China’s economic toughness has been an item of advanced commercial plans. The government has intentionally sought to restrict imports and diversify the financial system (mainly had by the state) in the direction of exports and manufacturing.

They powered every one of this via a decades-long state-driven drive to unnaturally raise financial savings and, therefore, financial investment. Simply put, the Chinese state has a lock, stock, and barrel supported its industry at every phase– commonly to the temporary hindrance of the Chinese customer.

On home turf, it is a well-known reality that the Chinese state has been busily biased towards its home expanded internet titans. Alibaba, Tencent, and Didi never had to manage the competitive competition that Flipkart or Ola Cabs have needed to in India.

China is Strong because of it’s Immoral Methods

China’s commercial toughness, whether in steel or solar panels, has the visible hand of the state behind them. China’s immoral and unrelenting subsidizing of the residential steel sector– which currently threatens to ruin Britain’s dwindling industrial base– has made China generate more steel than the rest of the world combined.

Likewise, China’s unexpected increase in manufacturing photovoltaic panels has stunted India’s and the USA’s quick-growing solar panel market. It is an apparent item of China’s Five Year Plans the solar market was an industry laid out for subsidies as well as tax debts.

Such techniques of state support through grants, compelled mergings, protectionism, and affordable finance encompass a lot of major industrial sectors in China.

People Already Know About These Cheap Tactics

Close China-watchers have recognized these techniques for long. Why such stories don’t make it to the front pages of Indian papers each time when we run startling trade deficits with China remains to be known. India China situation doesn’t seem too bizarre this time.

To ward off the Chinese obstacle, India requires to urgently pick a couple of leaves off China’s playbook as well as style its very own strategy towards advancement, which should undoubtedly be wholly pro-industry. This implies commercial policies, aids, and also if required, profession tolls.

India might choose to actively cushion residential internet champs, as Flipkart’s promoters have repetitively recommended, to limit their over-reliance on foreign funds. India should additionally prepare to step up state support to aid its recently established markets.

Solar panels, electronic devices, and capital machinery sectors are all vital areas where current capacity is inadequate to sustain the residential market and, hence, India is dependent on China.

In Conclusion

Undoubtedly, there will be criticism from India’s monetary papers that such procedures might ‘wear down competition’ and ‘elevate rates’ for customers. There might be some facts in it. The temporary– costs for consumers are likely to increase in the event of any crackdown on imports. Yet, as the Chinese instance programs, it is almost impossible to develop a feasible industrial base without state support.

However, most importantly, India, in its attempt to comply with a rules-based worldwide economic order, must recognize that China has never played by any of these rules. This suggests that any interventionist or protectionist strategy is up for grabs when battling Chinese economic encroachment upon Indian sovereignty. India China conflict will be different this time.

China is the most significant geopolitical and strategic risk that India is to encounter in the 21st century. Unusually, China’s substantial utilization over us– borne of its economic heft and political authoritarianism– is not a nationwide protection issue for the Indian facility. The duplicated border conflicts between India and China can someday escalate as they have in the past.

As well as when that occurs, do we believe that the Chinese Communist Party would refrain from using its massive impact over the Indian economic climate to hurt India?